Why Sports Retail Is Facing Its Biggest Challenge Ever

Craig Lovelidge at Unsplash

Sports retail is at a watershed moment. It might sound melodramatic, but let’s just take stock of what is happening before we consider what needs to change for them to not only survive, but thrive.

Earlier in the year Foot Locker’s share price fell by 34% as Nike geared up on DTC, beginning to cut out the retail middleman. Adidas has followed suit and all of sports retail needs to watch keenly, from the hardcore sport specialists, to athleisure groups like JD Sports.

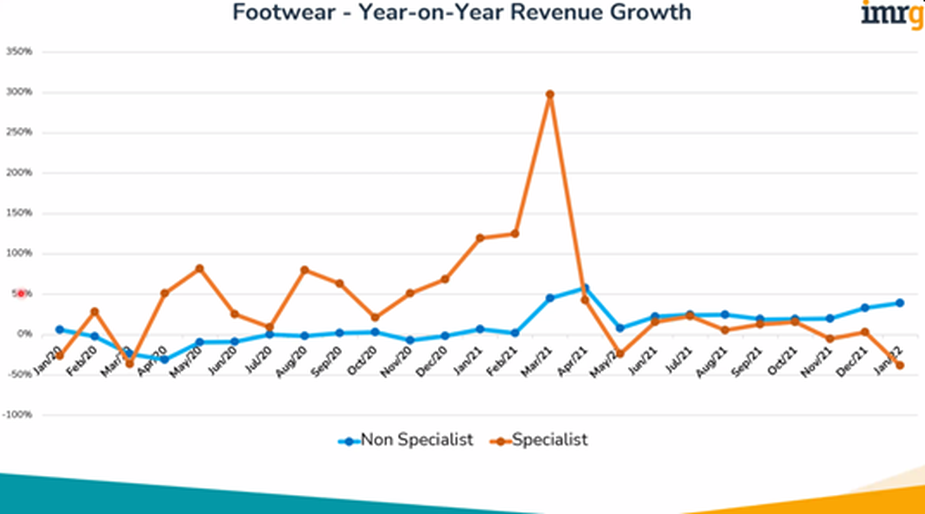

So what’s changed? During the pandemic people bought shoes (including trainers) from specialists rather than generalist retailers - see the table below from the data and insight business IMRG.

Was this a pandemic blip?

IMRG’s strategy and insight director, Andy Mulcahy told me that, “Shoppers seemed to migrate to the specialists during the pandemic when the high street shut down. They reported much higher growth rates during the lockdown months.”

It seems quite obvious really. As a consumer the thinking was, if we’re buying online anyway we may as well go to the source, but then it didn’t necessarily continue Andy said. So will we go back to the traditional chains?

Two years of lockdown has changed things. Nike has been transforming itself to sell direct, reducing stores and retail partners, part of its ‘marketplace for the future’ plan. The aim is to have a ‘premium shopping experience’ and they’re pulling out of Amazon and others as part of this shift to premiumise.

Nike’s CEO talks about a "one-Nike marketplace,” highlighting that their strategy "leads with Nike Digital" and the company's owned stores, and includes only "a small number of strategic partners."

In short, it’s not good news for those multi-brand stores as analyst Sam Poser comments. "Nike has the keys to most every large and small athletic retailers' success, and those keys are becoming more valuable."

Meanwhile in Spring last year Adidas’ launched its ‘Own the game’ strategy, with a shift to a DTC model that involves an investment of €1bn in digital transformation. They want online sales to be 50% of overall sales by 2025. Like Nike, this involves pairing down its retail partners.

Crucially, they want to triple membership by 2025 to 500m. Adidas co-creators Club has been rebranded and revamped to become the adiClub. Suddenly everything has been stepped up a few gears. And others are on it too, with Lululemon having just reported plans to double their revenues to £12.5bn within five years. To be expected, doubling digital revenues plays a key part in this.

Why? Put simply, building an online membership, an online ‘community’ is essential to meeting their DTC ambitions.

It was interesting watching the Liverpool v Manchester United England Premier League game a few days ago, but not only for the football! The electronic Nike banner at the side of the pitch at Anfield encouraged viewers to become members, for ‘exclusive’ products. This is at the heart of the problem for retailers who rely on selling Nike products.

And yet the brands that will succeed are the ones that go beyond viewing these as simple sales /ecommerce platforms. Community offers fresh opportunities to retailers.

This means sports retailers stepping up to the mark. Sports brands like Nike and Adidas will always have their unswayable loyal fans of the swoosh and three stripes, but multi brand retailers offer something that they can never offer; brand choice.

Retailers need to leverage its position around brand choice.

Foot Locker is taking some interesting moves to rectify this after an exclusive deal with Reebok’s new owners Authentic Brands Group, including lines from basketball star’s Shaquille O’Neal. The retailer will design exclusive shoes in collaboration with the Reebok team.

Some like Intersport have wide coverage within local communities which needs to be activated, while others like Decathlon are less dependent on brands but feel quite soulless and removed from consumers, from people. These challenges open new opportunities - how to connect, to bond, to build relationships, to build community. Others like JD may feel too powerful to feel the impact of any shift. After all, it has built up a group with some of the biggest sports retailers on the planet; from Finish Line, Shoe Palace and DTLR in the US to Spain's Sprinter and Sizeer in Eastern Europe. But that is to ignore the shifting landscape and power play taking place.

And yet physical retail does offer the chance for customers to ‘try before they buy’ as the senior director of digital sales at North Face explains below:

“Within e-commerce, there are still a lot of barriers to purchasing online, such as customers preferring to touch/try on products, wanting the product immediately, or favouring a face- to-face service. Online is constantly evolving to remove these barriers, such as offering super-fast delivery or live chat functions, and I'm excited to see this continue by connecting online to offline, whether through omnichannel services or augmented reality.”

Which leads onto the next point; customer experience. The physical store experience has to be good. By good, I mean pleasurable, useful, knowledgeable, speedy and successful! If it’s bad, people will use that as a reason to go online as a bad ‘human’ experience is worse than none!

In a recent IMRG webinar the ecommerce manager from FootAsylum (part of the JD group) spoke about the need to “hit them at their happiest,” ie, when they’re at their most interested and most likely to buy (more). Physical stores need to learn from their digital colleagues to build and maintain that relationship. Retailers need to adapt their instore experience to a new world, and continuously evolve this.

So here are some of my conclusions; retail brands cannot sit there and wait for the rug to be pulled from under their feet.

Retailers need to step up and take ownership; of products where possible and its community - rather than simply serving major sports brands needs.

By building their own community retailers and sports brands can build and own that relationship directly, reducing risk. People are looking for the best ‘fit’. They are actively looking to be part of something, of a community, but it has to have more depth than a means of selling products.

Having a point of view as a brand is increasingly important. In most cases it should be easier for retailers to have a point of view than the major sports brands it represents. Brands the size of Nike and Adidas have so many agreements with organisations like the NBA to individual football clubs, to specific sports stars that having a true independent voice can be difficult. So what is your voice as a retailer or even as a sports brand that might be tucked behind the might of the giants? What is your standpoint?

Finally, think about those collaborations - like Foot Locker’s with Reebok. 66% of the group that we're calling consumer activists (those expecting more of brands) are interested in brands with a strong collaboration programme. 85% of consumers want brands to head in “unexpected directions”. So defy the wave, be unpredictable and make a name for yourself, not as a supplier of other brands but as brand with a strong identity in your own right. It's time to break some of those old boundaries!