S4capital Grows One-Third like-for-like in the First Quarter of 2021

The company grew strongly in the first quarter, showing an acceleration in the like-for-like gross profit (net revenue) growth rate from 27% in the fourth quarter of 2020 to 33% and compared to 19% in the pandemic-affected first quarter last year. The two recent "whopper" wins started to have a significant positive impact in March. This represents an excellent start to achieving the Group's 2021-23 three-year plan of doubling its size on a like-for-like basis and of also achieving the previous 2019-21 and 2020-22 three-year plans, which both also called for a doubling.

As is our normal practice, we are in the process of revising our annual forecast at the end of the first quarter and we will raise our like-for-like gross profit (net revenue) target from 25% to 30%. The earnings before interest, taxes, depreciation and amortisation (EBITDA) margin was also strong in the first quarter, although we still expect to follow the pattern we have seen in 2019 and 2020, where the second half shows a stronger margin as hiring is made in the first half to accommodate the planned growth rate for the year.

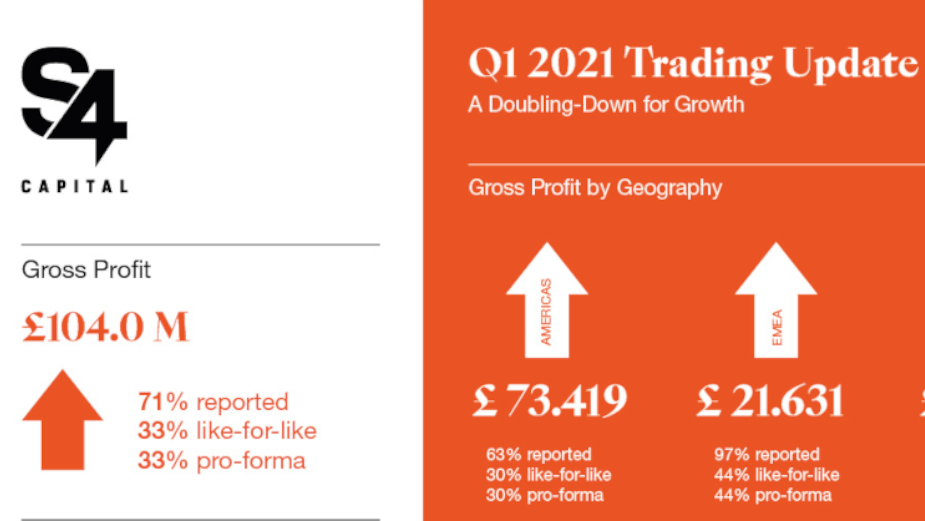

Reported revenue was up 71% to £121.6 million and gross profit (net revenue) up over 71% to £104.0 million. Like-for-like revenues and gross profit (net revenue) were up 35% and 33% respectively. Pro-forma revenues and gross profit (net revenue) were up the same.

The Group's Content practice, representing 72% of total gross profit (net revenue), was up 64% in reported revenues and 62% in gross profit (net revenue), up 35% and 31% like-for-like and the same pro-forma.

The Group's Data & digital media practice, representing 28% of total gross profit (net revenue), was up 100% in reported revenues and 101% in reported gross profit, up 35% and 36% like-for-like and the same pro-forma.

Geographically, all regions showed strong growth. The Americas, representing 70% of reported gross profit (net revenue), reported gross profit (net revenue) up 63%, EMEA, representing 21%, up 97%, and Asia Pacific, representing the remaining 9% up 95%. On a like-for-like basis, the Americas were up 30%, EMEA up 44% and Asia Pacific up 34%. On a pro-forma basis, all the regions grew at the same levels as like-for-like.

Cash flow remains strong, above the most optimistic scenarios mapped out in April of last year following the initial impact of the pandemic, with average net cash balances of approximately £50 million for the first quarter, after merger cash payments of around £95 million, following the equity issue of £113 million net in July, 2020.

Corporate activity

In the first quarter, the Content practice announced mergers with Decoded Advertising in the United States, Tomorrow China in China, Staud Studios in Germany and Jam3 in Canada. The Data & digital media practice merged with Metric Theory and acquired the assets of Datalicious Australia. These mergers and the ones before have turbocharged the firm's organic growth rate as significant revenue synergies have been identified and generated.

We continue to examine merger opportunities, especially in high growth functional areas of the Content and Data & digital marketing practices. We are prepared to leverage the Company to around two times EBITDA and are preparing a bond issue to lock in our long-term debt capacity at attractive rates. This, together with cash in hand and the 50:50 cash:equity merger structure we commonly use, will give us £500 million of merger transaction firepower.

In response to the murder of George Floyd, we have prioritised our diversity initiatives. In Q1 we have hired our first fellows on the S4 Fellowship programme, who are starting the four-year internship currently. We are recruiting from the historically black universities and high schools in the United States. In addition to the matching-funding programme last year and changes to our recruitment and training techniques, the Fellowship will grow our people of colour population to where it should be, reflecting the communities in which we work. It is currently at around 40%, with the black population around 5%.

While our gender balance is even across the firm as a whole, the proportion of women leaders drops at senior levels. In order to address this issue, we have initiated the S4 Women Leadership Programme at UC Berkeley. The first flight of approximately 50 women have already started their six-month virtual course. There will be more flights in future from across the firm.

On our broader ESG goals we have also made what we believe to be "industry-leading" sustainability commitments (others seem to have a different view): we commit to being fully carbon neutral by 2024 and have already started planting our S4 Forest; and we have made significant progress in our ambition to become a certified B corporation.

S4Capital's third annual report will be published on 10 May. Both digital and pdf versions will be accessible on the company's website at www.s4capital.com.

Managing the impact of Covid-19

Thankfully, we seem to be putting the pandemic behind us as vaccination programmes start to take hold, ultimately creating herd immunity. However, there are still waves of Covid-19 or its variants that flare up and Brazil, the Netherlands and India remain significantly affected in our geographical footprint.

First and most importantly, almost all of our 5,000 people in 31 countries and their families generally continue to be well and safe, although we are very concerned for our colleagues and their families in India, following the recent surge in cases of covid-19. As stated in previous reports, we have had very few reported cases of infection, subsequent illness and long covid. Most, if not all, of our people continue to work effectively from home, with varying geographic patterns. Asia-Pacific is coming back to the office fastest, with EMEA generally more cautious, North America returning and South America still hesitant. As digital natives, home working or a 24/7 approach was nothing new, almost business as usual and productivity has been maintained almost at previous levels.

We think the future attitude to working from home and attendance at the office will change. Although patterns may differ geographically, we believe that it is most likely that offices will be occupied on average for three days a week, for there to be more distance living and working and more flexible working hours and commuting times.

While there may be a need to develop and reinforce the culture of the company, particularly for new recruits (and we have had some 2,500 of them since this time last year), the pandemic has demonstrated that a more flexible, "hybrid" approach may be more effective. This is particularly the case as we are probably at the beginning of further significant technological change, which will make distance working and living more effective. Office spaces will also be different. We will continue to consolidate our two practices in each city into one location, but the pattern of office layout may vary between spaces for clients, spaces for our people to work together and for our people to have privacy.

Secondly, as we effectively represent a royalty on the growth of digital marketing transformation, we have benefited from our clients continuing to increase their investment in digital content and Data & digital media.

This has been accelerated, firstly, by the impact of the pandemic, which has accelerated the shift to online marketing amongst three communities - consumers, the media and enterprises. In addition, it has been accelerated by the snapback in global GDP growth after last year's decline, which is currently estimated to be 5-6% this year and 4-5% next. When was the last time we saw two sequential years when GDP growth was at those levels and with low levels of inflation, at least for now?

This all augurs well for digital marketing spend, as there is a clear correlation between GDP growth and digital marketing expenditure. Hence, the experts' forecasts of a 20% increase in digital spend this year, with digital's share rising to 70% of total ad spend by 2026, compared to 50% last year.

We are extremely optimistic about our prospects for this year and next, given the huge global fiscal and monetary stimulus introduced to counter the impact of the pandemic and the subsequent increase in consumer savings ratios and stagnation of corporate capital investment. The chickens may well come home to roost in 2023, given the debt burden that most countries will have and the tax increases that will have to be implemented. But, digital marketing expenditure remains robust, even in a recession, as our results last year demonstrate, given its secular growth trend.

Finally, our financial position and liquidity remain robust. We maintained net cash balances of approximately £50 million in the first quarter and outperformed even the most optimistic liquidity scenarios that we programmed for 2020 and beyond.

Conversion at scale accelerates

We achieved brand awareness following the formation of the company in the last half of 2018. We also achieved brand trial during 2019 and 2020, culminating in the significant content wins at BMW/MINI and Mondēlez in November last year.

Our first objective for 2021 is to focus on our 20 squared objective, which is to develop 20 clients with over $20 million of gross revenues, what we call "whoppers". We are projecting five for 2021, Google, another FAANG (NDA), BMW/MINI, Mondēlez and Facebook. We believe we will be able to target a further three tech clients this year, which would total eight, of which six would be in tech and telecommunications.

In addition, we have identified another two potential "whoppers", currently with revenue of $5-15 million per annum and another five, currently with revenue of $2-10 million per annum, all of which have the potential to be "whoppers" in time. That leaves five more clients to be identified. We are somewhat reticent to report progress on our 20 squared objective as analysts tend to add each "whopper" to our targets. Essentially, this objective will be achieved by a land & expand strategy, along with promising pitches and are part of achieving the overall targets in our three-year plans.

Our second objective is to roll out our unified brand. We are in the process of a soft launch to socialise the new identity with our people and our clients, in order to avoid the elephant traps some others have fallen into recently.

Finally, our third objective is to broaden and deepen our Content and Data & digital services through mergers or combinations.

In the first quarter, the Group's 'land and expand' and judicious pitch strategy resulted in significant new work with many of our larger clients such as Google, Facebook, Amazon, P&G, Mondelēz, AB Inbev and Netflix. Notable new business wins in the quarter include assignments from Diesel, N26, McLaren, Allianz, Crocs, Instacart, Shopify and Xero. In addition, in the first quarter, we have been invited to present for significant briefs from two major global FMCG or CPG clients.

New business activity is frenetic and the pipeline is significantly above the level at this time last year, with considerable current pitch and land and expand opportunities across the board.

We were disappointed to have to postpone our Capital Markets Day in Amsterdam last year, although we held it virtually later on in the year in September. As soon as travel restrictions are lifted, we will be organising a second Capital Markets Day in Amsterdam at our new consolidated offices. Full details will be sent to analysts and investors as soon as travel restrictions are lifted.

Digital transformation will accelerate rapidly over the next two years and beyond

We feel very optimistic about our Company and its prospects. Clients are focused on taking back control of their marketing functions, which favours our in-house, embedded or even outsourced capabilities. In addition, the privacy decisions by both Google and Apple and the resultant crumbling of third party cookies have all played to the strengths of our global data and analytics network and stressed the fundamental importance of first party data and the walled gardens.

As a result, the marketing VIX index (if there was one) has spiked, creating significant additional demand for our data & analytics and digital content and media expertise. Agility continues to be the key corporate attribute and our go-to-market mantra faster, better, cheaper or speed, quality, value is resonating increasingly with our current clients and potential ones. The pandemic has accelerated digital transformation. The recovery in global GDP and the secular trend to digital marketing provide strong tailwinds.