R/GA Rethinks Sports and the Future of Fandom

In 2015, the Los Angeles Dodgers launched the first-ever sports tech startup accelerator in partnership with R/GA Ventures. At the time, the Dodgers were embarking on uncharted territory given that before the launch, such a commitment to investment in early-stage technology and innovation from a professional sports organisation was rare.

At the conclusion of this effort, the sports innovation landscape looked a lot different. Investment in the space was up from $1.4 billion in 2015 to $2.4 billion in 2018 in North America. Investment firms and VCs had begun raising sport-focused funds and would continue to inject billions in new capital into the sports sector annually. Corporate stakeholders began to take notice of this increased activity and looked for ways to leverage emerging technology in their respective business models through capital investment and strategic partnerships.

To meet the increased corporate demand for startup exposure and engagement, the LA Dodgers and R/GA Ventures evolved the program in 2018 to focus on more corporate interests in sport, known today as the Global Sports Venture Studio (GSVS). Since inception, GSVS has partnered with some of the leading players in sport, including adidas, DICK’S Sporting Goods, E15 Group, FOX Sports, Levy Restaurants, Major League Baseball, Major League Soccer, National Hockey League, Octagon, and UEFA to advance their corporate innovation strategies and venture investment efforts. Although our partners operate within separate industries within the larger sports ecosystem, each shares a common objective - develop new ways to expand your membership base (e.g. the consumers you have a direct relationship with) and grow the value of each customer (or fan).

In this article, we’ll outline the implications of several recent trends that may serve as indicators of the future of fandom and suggested next steps for the organisation looking to deepen their connection to their customers and culture.

2020 is Changing What it Means to Engage

With an unforeseen global pandemic and concerning amounts of social unrest, the year 2020 will be remembered as the U.S’ inflection point in which an already siloed society further separated. Sports, seemingly one of the country’s only common threads, was significantly disrupted as well. This year’s uncharted territory will prove that the silver lining will create the next wave of prospective sports fans who will likely consume sports like never before.

- Source: Insider

We will take a look at the following opportunity areas as starting places for today’s sports organisations to hone their strategic efforts in growing fan engagement. At a high level, we’re quickly learning that industry leaders simply can’t overlook the importance Gen-Z will play in keeping businesses growing, brands in check, and staying culturally relevant.

01/ Content Takes a Kingdom

Observation

Like most industries, Covid-19 accelerated the imminent realities for stakeholders in the sports media space, and taking a more hybrid approach to media rights deals will likely happen sooner rather than later. As a result of canceled spring sports (at the professional and collegiate levels) and autumn sports (at the collegiate level), many fans were, and still are in some capacity, left without engaging content to indulge in.

Source: Distractify

To fill this void for fans, content providers like TikTok stepped-in and helped sports organisations sustain fan engagement by meeting fans where they already were - external content platforms. The current pandemic has inherently led to increased engagement on social media across younger generations. TikTok saw an impressive 315 million downloads during the first quarter of 2020 and an additional 200 million total in May and June. What’s more, 60% of TikTok users are Gen-Z.

Additionally, researchers assert that nearly half (42%) of the Gen-Z population sought 'fun' content during the peak of the quarantine period. As a result, we’ve seen a flood of partnership announcements between sports properties and content providers, which may prove to be a market shift that’s here to stay. Kyle Bunch, managing director for GSVS, highlights some of the initiatives that the LA Dodgers have taken to diversify their digital engagement strategies this year in a recent R/GA Live webinar seen here.

Notable sports content engagements that were announced in recent months include:

· August 17th: Bleacher Report and MLS

· August 12th: TikTok and New York Yankees

· July 30th: NBA, Yahoo Sports, RYOT

· July 28th: Disney, NHL, and Twitter

· July 22nd: Twitch, NBA, NHL, UFC, and more

· July 14th: WAVE.tv and IMG

· June 12th: Snapchat renews NFL, NBA, and ESPN

In addition to the content providers mentioned above, several startups in R/GA Ventures’ portfolio position themselves to provide corporations with assets to help them better attract targeted audiences. Companies such as QuickFrame, Perksy, and more are examples of emerging tech platforms that aim to help global businesses innovate.

Opportunity

Going forward, media rights deal structures must account for the accelerated growth of short-form video consumption. Soon, sports fans can expect to see more large media entities 'team-up' with newer tech partners (i.e., ESPN/Snapchat) to deliver the style of content they’re craving. When assessing new rights deals, sports teams should favour the media conglomerate that exhibits an in-depth knowledge of short-form and immersive video.

As stadiums remain closed to the general public, sports entities should lean more into short-form content production and look to leverage third-party content curators to help bring innovative media to life.

Cancellations of matches and the shuttering of stadiums worldwide have also carved a prime market opportunity for Gen-Z-focused sports content providers (i.e., WAVE, Overtime) to establish short form, Gen-Z-friendly content as commonplace in larger rights negotiations moving forward.

Linear TV viewership is declining, and some have partially attributed this decline to young people’s disinterest in sports, which is a common misconception — they’ve just transferred platforms. Given the abundance of recently-announced sports content partnerships, the market appears to be prime for ensuring sustained growth of Gen-Z fan engagement in the coming years.

02/ Politics Are in Play

- Source: Washington Times

Observation

While political statements and gestures have been commonplace in sports since desegregation, these occurrences were largely fragmented in nature; it would take several decades for American athletes, teams, and leagues to exhibit a unified stance in denouncing the mistreatment of people of colour by police and hate groups.

Recent examples of police brutality seemed to catalyse unprecedented organisational strikes in sports, spurred by the NBA’s Milwaukee Bucks’ refusal to take the court during their August 26th matchup against the Orlando Magic. American sports leagues, including NBA, WNBA, NFL, MLB, MLS, and NHL all stood in solidarity to protest the police shooting of Jacob Blake - we even saw non-traditional sports take strike as eSports team Chaos EC withdrew from their tournament with Team Liquid. In addition to promoting meaningful and overdue societal change, the acts of protest may be inadvertently attracting a younger, socially conscious audience to sports.

Opportunity

The politicisation of sports has led to decreased viewership during the recent months, as many fans tune into sports matches for entertainment to escape political, social, and global health content fatigue. Now that leagues and media properties are beginning to align their respective values with the current times by airing more political content, viewership metrics expect to take a dip, but it is unlikely that the decline will last very long.

Various research reports suggest that Gen-Z is one of the most socially-conscious generations to date, and Gen-Z consumers’ brand loyalty is largely dependent upon whether a given brand exhibits similar cultural values. Given this notion, while sports organisations are voicing their positions on the perils of police brutality that people of colour face in America, they are unlocking interest and engagement from younger audiences as a result.

- Source: Twitter

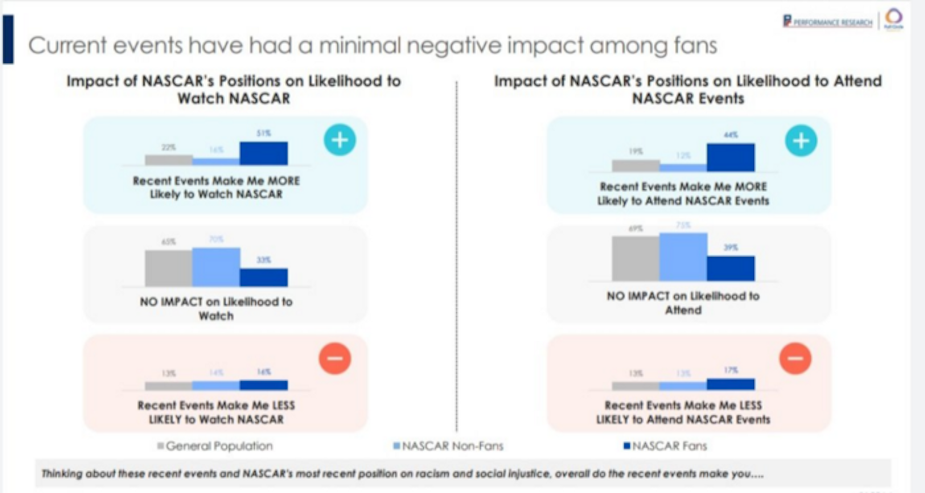

Recently, we’ve seen NASCAR take a firm stance against the display of the confederate flag during its races. While many expected the ban to have an adverse effect on NASCAR’s fandom and viewership, the results of a recent study assert that an overwhelming percentage (76%) of fans under the age of 40 years were in favour of the ban; just 16% said they’re less likely to watch and 17% said less likely to attend. Conversely, 22% of the general population said that they are more likely to watch NASCAR as a result of the organisation’s announcement. The recent NASCAR fan reactions to the removal of the flag seem to suggest that the organisation is attracting new fans while not losing current fans when incorporating more of a political narrative within the sport.

As younger consumers assume more buying power in the coming years, sports organisations and media properties alike must continue to meet younger fans’ needs in the places and platforms they already use to sustain engagement in the future. Continuing to denounce acts of police brutality and taking a firm stance on other social issues will inevitably draw socially-conscious generations because they identify with such messages. We expect viewership to gradually rebound as a direct result of leagues agreeing to protect the minority athletes that help produce their widely-demanded products.

03/ Culture has an Interface

Observation

Due to the inherent differences in interests between earlier and later generations of sports fans, society has witnessed intergenerational conflict spurred by the rise of technology. Sports’ cultural shift to adhere more to future fans’ interests exacerbates the generational divide and may lead to players in the media landscape becoming lean and forcing fans of all ages to be on 'the same page' regarding how they watch sports.

- Source: Bandt

With Baby Boomers acting as the base of traditional PayTV, the market-shift towards 'cord-cutting' is a necessary one in order expand the opportunities for revolutionary media as the content generators that are Millennials, and Gen-Z expects a more future-forward approach as it relates to the type of content that they consume and how they consume it. We expect to see sports and culture become synonymous in the coming years as younger fans gain more influence over how sports are displayed to them today; the democratisation of media now allows fans to personally create the content that they want to see if their needs aren’t being met through traditional channels.

Opportunity

Devising strategies on integrating user-generated content (UGC) into daily brand activities may prove to be beneficial for the sports property who is looking to double-down on their Gen-Z engagement efforts. The gaming space has been able to execute this idea fairly well as more non-endemic brands are looking to market through emerging channels, and there have been a stampede of marketing tech startups over the past year that have developed platforms to help established brands find popular streamers for product placement opportunities. The current use of digital fan videos in venue may serve as a seamless opportunity for stakeholders to allow well-known influencers to integrate their UGC into live sports as a potential method to attract and retain younger fans.

Looking Ahead

Despite recorded declines in viewership across several sports largely due to events involving global health, social division, and politics, the market opportunity to grow fan engagement is quite significant when assessing the interests of younger generations.

The needs of Generations Z and Alpha will largely be taken into consideration during upcoming media rights negotiations, which will likely incur lower valuations partially due to the abundance of digital options and how these generations expect to consume sports going forward. These opportunity areas should serve as potential starting places for stakeholders interested in evolving their products and services to sustain engagement from the next wave of sports fans.