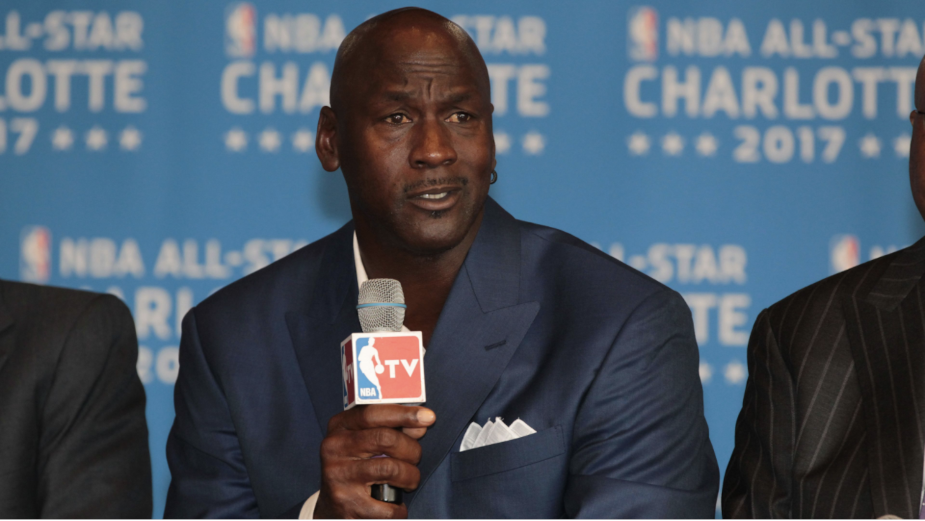

How Michael Jordan Reshaped the Financial Journey for In-tune Athletes

There were few surprises at the start of November when Sportico named its estimated list of the 25 best-paid athletes of all time.

At the top of the rankings was Michael Jordan, with lifetime earnings from sport calculated at $2.62 billion. Around $1 billion of that is understood to have come through payments from Nike since Jordan retired a little under two decades ago. I get it - he is still my number one all-time favourite athlete!

Now 58, the Chicago Bulls icon worked with Nike as a footwear partner almost throughout an unparalleled career in the National Basketball Association (NBA). Yet as important as his on-court achievements and peak-level fame were in ensuring the value of that endorsement, what really delivered for Jordan was the development of his signature Jordan Brand. The rights he holds to that subsidiary are the bedrock of his fortune, which is significant enough that he has owned an NBA team, the Charlotte Hornets, since 2010. He also moved into motorsport ownership with Nascar team 23XI this year.

Athletes have been learning the lessons of Jordan's career since the late 90s, both in terms of elite performance and financial security. For many of the current breed of stars, shrewd investment and equity in businesses are at the core of their future prosperity.

That much became clear in early November when Coca-Cola made the largest brand acquisition in its history, paying $5.6 billion in cash to complete a full takeover of sports drinks brand BodyArmor. The soft drinks giant had taken a 15 per cent stake in 2018.

Within the sports drinks category, the move is intended to help Coca-Cola recover ground on its global rival, PepsiCo, whose Gatorade drink is the market leader. BodyArmor recently overtook Coca-Cola's own Powerade brand to move into second place in the US.

Interestingly, however, the BodyArmor takeover will mean a windfall for dozens of athletes across the NBA, the Women's National Basketball Association (WNBA), the National Football League (NFL), Major League Baseball (MLB) and Nascar. The estate of the late NBA great Kobe Bryant stands to earn $400 million from the deal, while other investors cashing out include the Golden State Warriors Klay Thompson, four-time NFL Super Bowl winner Rob Gronkowski, and 2020 Masters-winning golfer Dustin Johnson.

Moreover, while spin-offs and licensed brands have been a feature of the endorsement landscape for over a generation, and the best-paid sportspeople have been curating portfolios for some time, the levels of sophistication and diversification away from sports companies continue to rise. NBA superstar Stephen Curry has invested in major tech firms as well as rising software as a service (SaaS) enterprises.

His rival LeBron James courted minority investments in his media company, SpringHill Entertainment, in October, with backing from the likes of Nike and Epic Games taking the group's value to around $725 million.

Leading athletes are prepared to take their investment activities even further. The Brooklyn Nets' Kevin Durant has already bought stakeholdings in sports technology startups, media businesses, health and wellness brands and collectables brokers, as well as cannabis companies and cryptocurrency platform Coinbase. According to public filings with the US Securities and Exchange Commission (SEC), he has "a diverse portfolio of over 70 venture investments".

He was an early backer of Dapper Labs, the non-fungible token (NFT) specialist which has risen to prominence since it created the NBA Top Shot market – the scene of hundreds of millions of dollars of trading in blockchain-enabled digital collectables in 2021. Durant and his long-serving manager, Rich Kleinman, recently confirmed a two-year partnership of their own with Dapper Labs through their companies, The Boardroom and Thirty-Five Ventures.

Durant is now preparing to launch a special-purpose acquisition company, or SPAC – an organisation formed to raise funds with the purpose of acquiring or merging with an existing business to take that business public.

He will be the co-CEO of Infinite Acquisition, which is looking for up to $200 million in funding from new investors and is thought to be interested in merging with a company in the sports, health, food tech, ecommerce or cryptocurrency sector. Beyond that, the specifics are not yet known at this point.

"We have not selected any business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target," said a statement issued by Durant and Kleinman as they filed paperwork to create their new SPAC.

It remains to be seen whether Durant's latest endeavour will pay off but it is clear he is part of a cohort of top performers who are taking their investments as seriously as they have taken their playing careers. And as our local sports stars grow their average wage, we are starting to see some of this play out here in Australia too.

As athlete incomes continue to rise and the opportunities away from competition move in so many new and often unpredictable directions, the financial maturity of those undertakings will only deepen.

Matthew Pavlich is a Nine sports presenter and co-founder of Pickstar