GfK Reveals Latest Australian Consumer Trends for 2023

There’s no escaping today’s challenges. However, excuses very rarely (if ever) lead to positive outcomes. That’s why GfK, a global leader in data analytics and consumer behaviour insights, believes now is the time to start finding opportunities.

At its recent GfK’s Insight Forum: Finding Opportunities, Not Excuses held in Sydney on 16 November GfK’s Head of Consumer Intelligence and Consulting ANZ, Mitesh Khatri, revealed the company has been tracking consumer values in 30 markets around the globe for a quarter of a century.

“Hybrid environments are driving increases to our lives at home, particularly around strong premiumisation and indulgence. For example, instead of dining out, more and more people are choosing to cook at home or order from a food delivery service,” he explained.

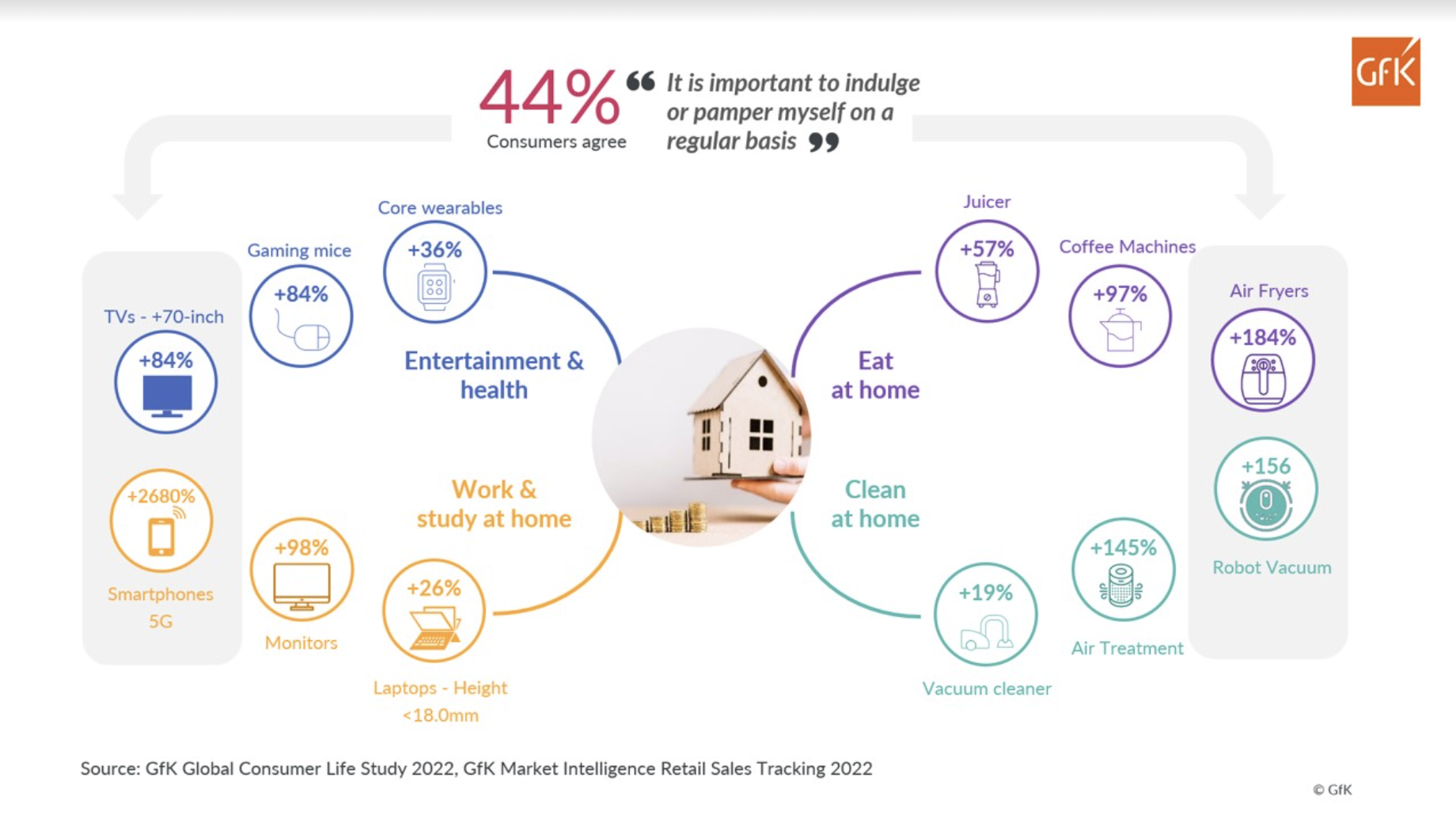

In this “new world”, GfK research shows 44 per cent of Australian consumers say it is important to indulge or pamper themself on a regular basis.

This sentiment has led to an increase in purchases across the home in areas like entertainment, health, work, study, cleaning and dining. For example, there’s been a 57 per cent increase in juicer purchases, 184 per cent air fryer purchases and 2,680 per cent increase in Smartphones 5G purchases.

“We’re looking for convenience, and we’re buying into technology and appliances at home. And it’s not just products. Subscription video on demand is also seeing significant increases as we spend more time at home. At the same time, radio streaming has seen more than a 122 per cent increase,” he said.

For brands, GfK research reveals that for higher-spend items like food processors, dishwashers, ovens and fridges, consumers want to be educated and inspired in-store. However, when it comes to smartphones, laptops and fitness wearables, Australian consumers generally go into the store knowing exactly what brand/model they want. The opportunity there is to upsell them on accessories like cases and extended warranties.

“Marketers can capitalise on category premiumisation — a trend that is driving strong sales value growth. It’s time to invest in the right marketing touchpoints, pre-store versus in-store with core messages of value versus trade-up,” he concluded.

Data accessibility a major issue

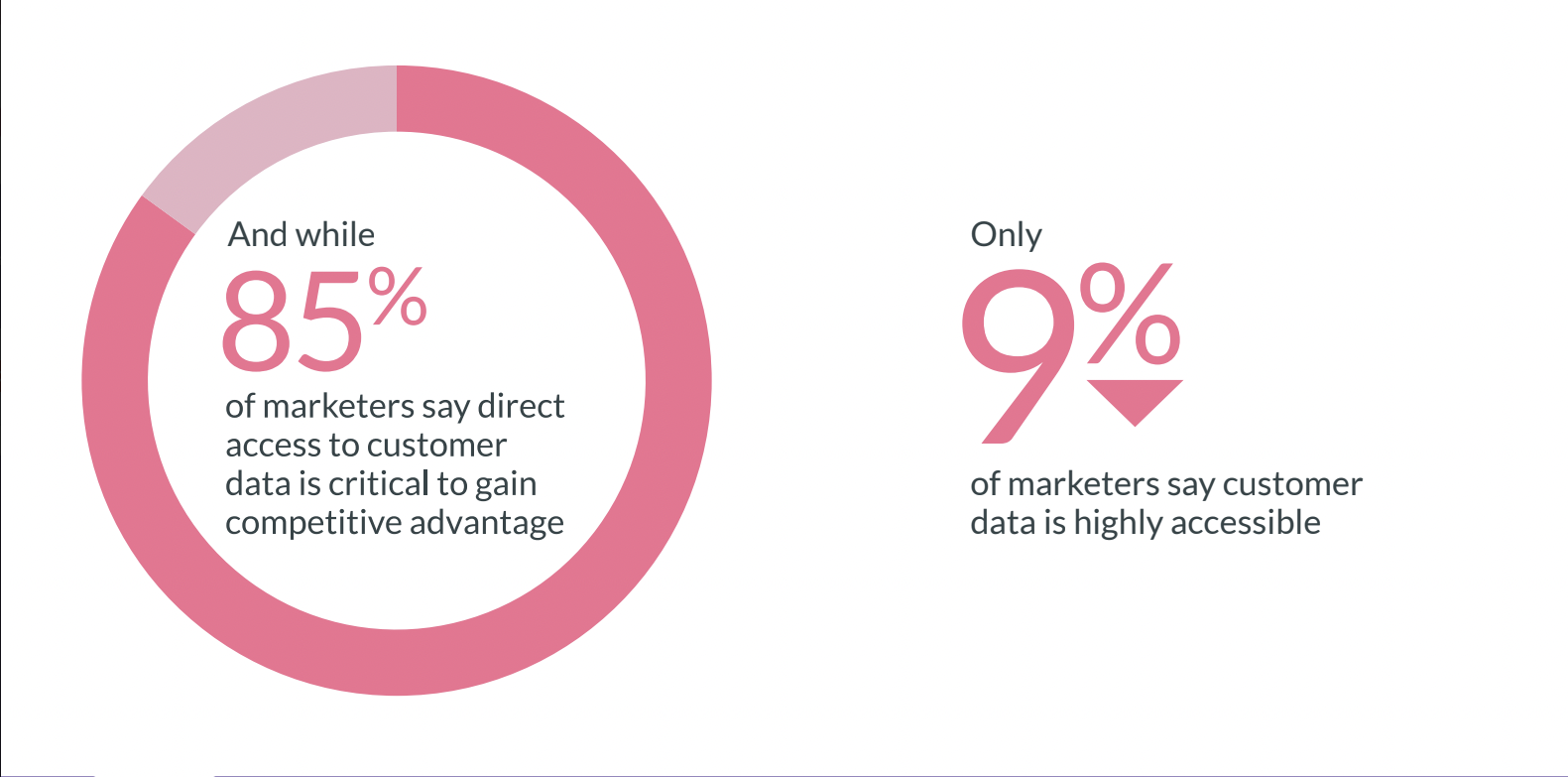

In organisations across Australia, data accessibility is a major issue. According to GfK research, only 1 in 4 marketers are very confident in the data systems they use to win and retain customers. Even more, whilst 85 per cent of marketers say direct access to customer data is critical to gain a competitive advantage, only 9 per cent of marketers say customer data is highly accessible.

So what’s holding them back? Three things: the budget to improve martech, systems and processes that connect data silos, and talent to move from data collection to action. GfK research shows that once marketers have data, gathering actionable insights is slow. Only 18 per cent of marketers say they can move quickly from data gathering to actionable insights.

“This begs the question then, what are those 1 in 4 marketers who are confident in their data systems doing differently? They’re creating a holistic strategy, taking them from macro trends to micro-targeting to niche insights,” Mitesh said.

5 questions to ask to power your marketing strategy:

- Present: Against unfavourable macro-economic trends, where are the growth opportunities

- Future: How do we plan for the future?

- Where: Where should we target and advertise?

- Who: Who should we be targeting and how to reach them?

- How: With so many different data sources, how do we form it into one coherent piece?

Finding opportunities, not excuses

Now is the time not to make excuses but to drive actionable insights from trends. It’s time to understand deep consumer values that shape behaviour in your business, and pivot your strategy as the world recovers to a new era of consumerism. When met with macro-economic trends that create a “doom and gloom” scenario, remember home is the HQ. There’s been strong growth for consumer durables, up 12 per cent, GfK revealed.

“In this new world, consumer behaviours are different. Find opportunity in understanding and using values as foundations for your brand strategy to pull apart your industry or category landscape. And when mountains of data leave you feeling overwhelmed, create a roadmap for improvement that balances human intuition with data intellect to drive better business outcomes,” Mitesh concluded.