'Cultural Catastrophe' to Lose Over 400,000 Creative Jobs in UK

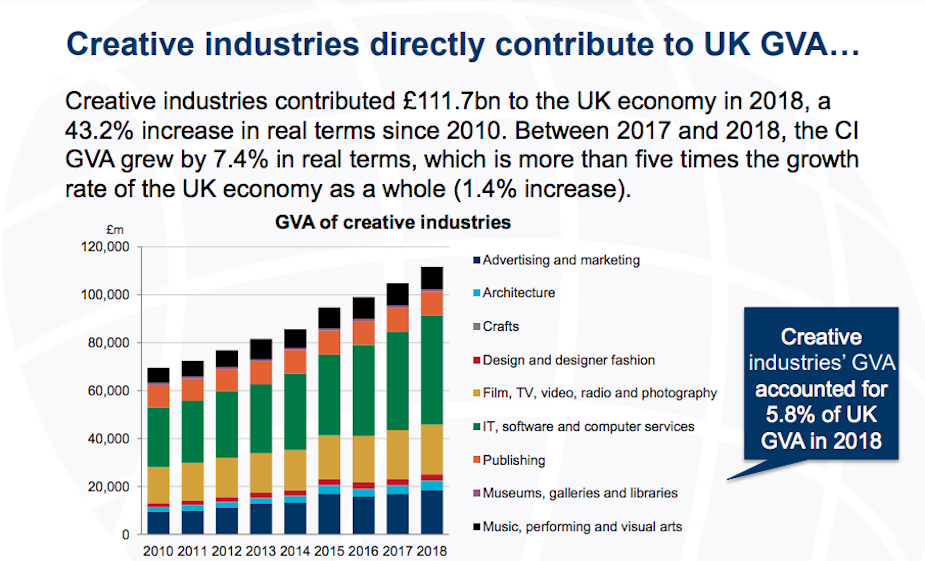

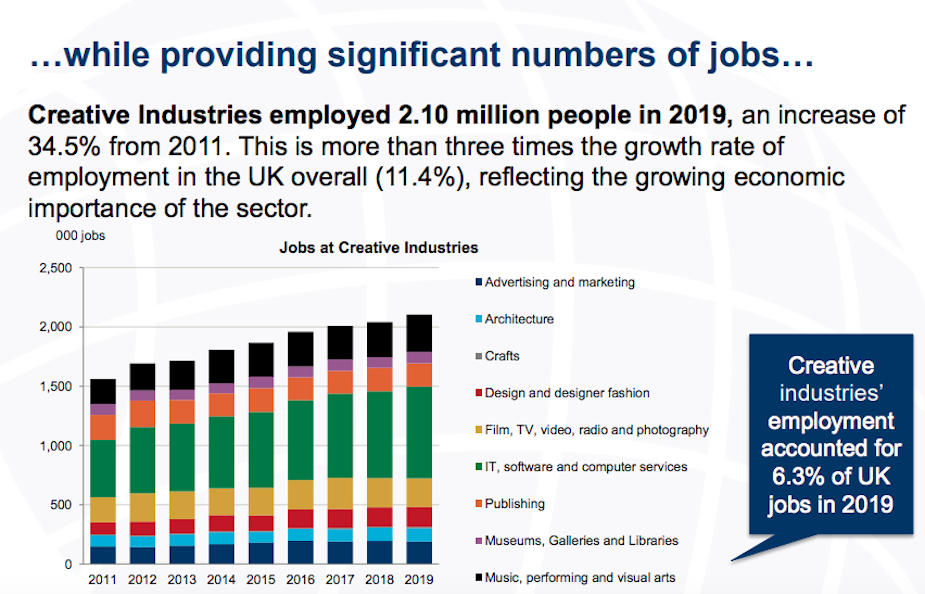

The Creative Industries Federation has today warned of a 'cultural catastrophe' as newly commissioned research from Oxford Economics reveals that the UK’s creative industries are on the brink of devastation. The UK’s creative sector was previously growing at five times the rate of the wider economy, employing over two million people and contributing £111.7 billion to the economy - more than the automotive, aerospace, life sciences and oil and gas industries combined.

The Advertising Association has been working with colleague from all parts of industry within the Federation on the research, which has been conducted by Oxford Economics, and as you can see, the results should be a cause of concern for all.

The new report 'The Projected Economic Impact of Covid-19 on the UK Creative Industries', projects that the creative sector will be hit twice as hard as the wider economy in 2020, with a projected GVA shortfall of £29 billion. Many creative sub sectors are expected to lose more than half their revenue and over half of their workforce. Despite the Job Retention Scheme, the report projects that 119,000 permanent creative workers will be made redundant by the end of the year. The impact on employment is set to be felt twice as hard by creative freelancers with 287,000 freelance roles expected to be terminated by the end of 2020.

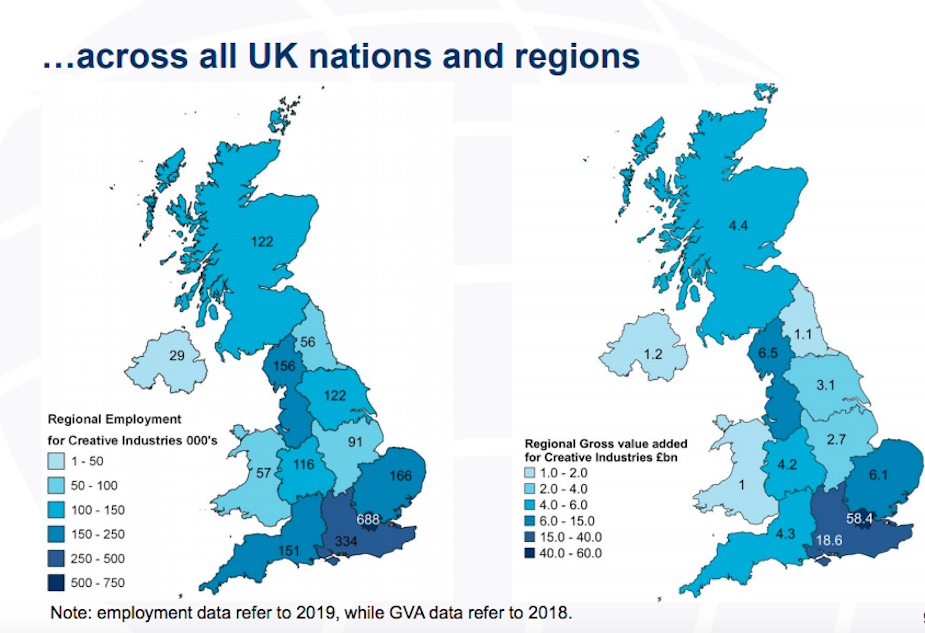

Regionally, London is projected to experience the highest drop in creative industries GVA, seeing a £14.6 billion (25%) shortfall. However, Scotland and the North East are expected to be hit hardest relatively, with projected GVA decreases of 39% (£1.7 billion) and 37% (£400 million) respectively. One in six (112,000) creative jobs could be lost in the capital, with the West Midlands expected to be most impacted in relative terms, with two in five creative jobs in the region projected to be lost. The North West and South West will also be hit hard, with both projected to lose around a third of creative jobs. This could represent a major setback to the levelling up agenda, particularly in light of research from Cambridge Econometrics, released by the PEC/Creative England this week, which suggests that, based on recovery from the 2008 recession, creative industries outside of London may take much longer to ‘bounce back’ than those in the capital.

Tom Kiehl, acting CEO, UK Music, said: "Year after year the UK music industry is a proven winner for our economy, job creation and exports, as well as positively impacting other sectors like tourism. Coronavirus has turned our world upside down, with catastrophic consequences across the industry and beyond. The music industry is resilient, but this means knowing when to ask for help. We need help to restart our economy, help to preserve jobs and help to maintain the UK’s fundamental position as a net exporter of music across the rest of the world."

Key statistics:

- Creative industries GVA projected to fall by £29 billion (-25%), with the creative industries being hit twice as hard as the wider UK economy*

*OBR estimate for UK GDP growth this year is -12.8%.

- Creative industries projected to lose 406,000 jobs and £74 billion in revenue (-30%).

- Music, performing and visual arts projected to lose £11 billion in revenue (-54%) and 57% of jobs (178,000) with theatres, recording studios and concert venues remaining closed.

- The music industry is projected to lose at least £3 billion in GVA (50%) and 60% of jobs (114,000), with the sector being hit hard by the collapse in live music and touring.

- Theatre projected to lose £3 billion in revenue (61%) and 26% of permanent jobs (12,000), although this estimate only takes into account current cancellations and does not account for the reluctance of audiences to return to venues (only 20% would return on opening night according to a survey by Indigo). Further research from UK Theatre/SOLT shows that, without further intervention, job losses in theatre across permanent and freelance roles is likely to number over 200,000 (over 70%).

- Film, TV, video, radio and photography could lose £36 billion in revenue (-57%), with the sector projected to lose 42% of jobs (102,000) as social distancing constraints affect cinema capacity and the cost of filmmaking.

- Postproduction and VFX could lose £827 million in revenue (-58%).

- Radio projected to lose £186 million in revenue (-21%) as it sees a decline in advertising.

- Crafts could lose £513 million in revenue (53%), with the craft economy projecting to lose 47% of jobs (58,000) as many craft practitioners experience the fallout of closed workshops and retail spaces.

- Design and designer fashion within creative industries could lose £2 billion in revenue (-58%) and 30% of jobs (51,000). When we look at the reach of design across the economy, the risk is far greater, with a potential GVA drop of £37 billion (-47%) and over 300,000 jobs projecting to be lost.

- Advertising and market research could see their turnover drop by £19 billion (-44%) projecting job losses of 26% (49,000), with spend on advertising expected to drop by £4 billion in 2020 (-17%).

- Publishing could lose £7 billion in revenue (-40%) and 26% of jobs (51,000), affected by the closure of bookshops and decline of print sales.

- Museums and galleries could lose £743 million in revenue (-9%) and 5% of jobs (4,000), with the impact being mitigated by being able to reopen in July under social distancing constraints.

- Architecture projected to lose £1 billion in revenue (-24%) and 2% of jobs (1,800 jobs).

Andy Harrower, CEO, Directors UK, said: “It is vital that the Government offers meaningful support to the creative sector at this critical time. The films and television programmes directed by our members have kept the country entertained, informed and connected during lockdown. The majority of screen directors are freelancers and lost almost all of their work as the production industry ground to a halt. Many were unsupported due to gaps in the financial support available and a full return to work is likely to be slow and challenging as production adapts to safe working. UK television alone creates £3 billion of revenue and £1.4 billion in exports. Government intervention is needed now to support the industry and its workforce in getting back to work, and maintaining the UK’s global position as a centre of excellence for film and television production and creative talent.”

Regional breakdown:

London is projected to lose 16% of its creative jobs (109,800) and see a 25% (£14.6 billion) drop in creative industries GVA whilst the South East is projected to lose 24% of its creative jobs (82,000) and see a 25% (£4.7 billion) drop in creative industries GVA. Of the 406,000 creative jobs expected to be lost, 47% are projected to be in London and the South East. The East of England is projected to lose 25% of its creative jobs (42,000) and see a 31% drop (£1.9 billion) in creative industries GVA.

Scotland is projected to lose 6% of its creative jobs (7,000) but see the largest percentage drop in creative industries GVA (39% / £1.7 billion). The North West is projected to lose 30% of its creative jobs (48,000) and see a 30% (£1.4 billion) drop in creative industries GVA .

The West Midlands is projected to be hit hardest in terms of job losses, with 43% of creative jobs projected to be lost (51,000) and a creative industries GVA shortfall of 32% (£1.4 billion). The South West is projected to lose 28% of its creative jobs (43,000) and see a 29% (£1.3 billion) drop in creative industries GVA. The East Midlands is projected to lose 1% of its creative jobs (1,300) but see a 31% (£800 million) drop in creative industries GVA, owing to a greater use of the furloughing scheme. However, the region is projected to be amongst the hardest hit once the Job Retention Scheme is withdrawn.

The North East is projected to lose 3% of its creative jobs (2,000) but see a 37% (£400 million) drop in creative industries GVA, owing again to a greater use of the furloughing scheme. However, like the East Midlands, the region is projected to be hit harder once the Job Retention Scheme is withdrawn.

Northern Ireland is projected to lose 20% (6,000) of its creative jobs and see a 23% (£300 million) drop in creative industries GVA. Wales is projected to lose 26% (15,000) of its creative jobs and see a 10% (£100 million) drop in creative industries GVA. Yorkshire is projected to see a 3% (£100 million) drop in creative industries GVA.

The report, released today, follows the Creative Industries Federation’s open letter to government in April calling for urgent funding for the creative sector, which was signed by over 500 leading figures from the creative industries and beyond. In May, the Creative Industries Federation joined forces with UK Hospitality and the Association of Leading Visitor Attractions to call for an extension of the Job Retention Scheme and Self Employed Income Support Scheme, as well as the introduction of targeted grant support for those sectors who will be last to return to work.

Caroline Norbury MBE, CEO, Creative Industries Federation, said: “With the economic impact of Covid-19 hitting hard, the role of our creative industries has never been more critical. As well as being a huge driver of economic growth in every part of the UK, our creative and cultural sectors bring communities together, they employ millions and are at the heart of our soft power. These are the industries of the future: highly innovative, resistant to automation and integral to both our cultural identity and the nation’s mental health. We’re about to need them more than ever. Our creative industries have been one of the UK’s biggest success stories but what today’s report makes clear is that, without additional government support, we are heading for a cultural catastrophe. If nothing is done, thousands of world-leading creative businesses are set to close their doors, hundreds of thousands of jobs will be lost and billions will be lost to our economy. The repercussions would have a devastating and irreversible effect on our country."

Norbury continued: "We urgently need a Cultural Renewal Fund for those in the creative sector who will be hit hardest, including those industries who will be latest to return to work, those businesses unable to operate fully whilst maintaining social distancing and those creative professionals who continue to fall through the gaps of government support measures. We must also avoid a cliff-edge on vital measures such as the Job Retention Scheme and the Self Employed Income Support Scheme, which have been a financial lifeline for many parts of the creative industries and cannot be cut off overnight. It is time to both imagine and engineer our future. We will need our creative industries to do that. They are too important to ignore.”

Julian Bird, chief executive, UK Theatre and Society of London Theatre (SOLT), said: “The UK’s theatre industry plays a key economic, social and place-making role. Theatre and the performing arts make a powerful contribution to our society and to our diverse national identity. They make areas richer culturally and financially, and they make places more attractive to live and work. UK Theatre is a global success with our productions filling cultural venues from Broadway to Beijing. However, the impact of Covid-19 on the theatre industry has been immediate and devastating; with every UK venue now closed. Covid-19 has removed the sector’s trading income entirely at a stroke and thrown its business model into crisis. In order to rescue the performing arts sector, we call on government to: sustain the workforce; catalyse the recovery; and review insurance and liability policies to ensure this valuable asset is protected and enhanced for the future. We hope this report goes some way to helping this happen.”