Behind the Work: Why a New US Bank Is Reimagining the $20 Bill

In theory, banks should be there to support people; a safe haven for our finances and security for when we find ourselves with less than we’d hoped for. The reality isn’t really so. Banks charge their customers for having an account in overdraft, furthering financial problems instead of aiding in their repair. In the US, it’s difficult for many to even open a bank account, a particularly huge problem in a country that pretty much runs itself on the quality of a person’s credit score. As Stefan Schuette, CEO of Serviceplan New York, eloquently puts it: “Money still follows money.”

But he and his agency are working with a new type of bank, Varo, which is bringing American banking into the 21st century with a fully mobile experience that is open to all. Over the last month or so, Serviceplan has been rolling out the debut campaign for the bank on TV - including during the Super Bowl in selected states - in outdoor, and a digital element that incorporates a neat augmented reality aspect.

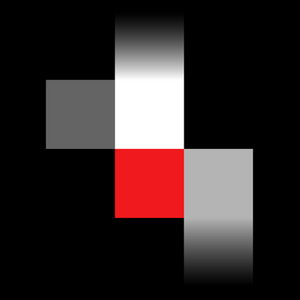

At the heart of the campaign is a central spot that showcases the individuals who reflect the beating heart of America’s wide-reaching, diverse society. Brilliantly produced by Scholar, the film brings money to life with a unique style of animation. The hero visual featured across the campaign is the iconic $20 bill, re-imagined with portraits of everyday Americans. Coincidentally, the Varo campaign launched a few weeks after the revival of plans for a portrait of the anti-slavery activist and prominent abolitionist Harriet Tubman to feature on the US $20 bill.

To find out more about the campaign, LBB's Addison Capper chatted to Stefan, CEO of Serviceplan New York, and Kevin Proesel, managing director of St. Elmo’s Germany, who worked on the AR element.

LBB> What was the initial brief from Varo? And what were your initial thoughts when you saw it?

Stefan Schuette> We all thought: what an exciting assignment. Here comes a truly different bank after all. Finally there is a bank that helps everyone who has been left behind by traditional banks. So many brands talk about a purpose – Varo has a true and meaningful purpose. With real products to get someone in need to his or her next paycheck without the humiliation or the fees. This can make the difference for a single parent or someone in a slowly growing small business. This is why you want to stay up all night as an agency and try something truly great.

LBB> Can you tell us a bit about Varo as a brand? Where does it sit within the US financial market?

Stefan> Varo is one of those awesome new fintechs with a modern and innovative business approach. As you know, there was so much need to remove barriers and enable people to get money transferred more easily, making banking more convenient - basically reinventing banking for the world. Varo aims to make financial services mobile, seamlessly digital and much less complicated. Now Varo has also become the first fintech provider to obtain a national bank charter and is the only fully integrated one with the means to create and reinvent banking.

LBB> Why did you decide to focus on America's diversity as a nation as the central point of the campaign?

Stefan> Traditional banking is often largely related to privilege in the US - money still follows money. It is hard for people with less money or less definitive income to improve their credit score or get the help they need to improve their financial resiliency, especially in tough times.

It’s hard for some people in the US to get a bank account at all. So that’s where Varo bank comes in, to offer easily accessed digital banking services to those with more challenging financial situations, and for a new digital-first generation who are looking for a bank that offers something more modern. People want to be treated and talked to differently, and with our Varo campaign we wanted to make everybody understand that they can be part of this new banking community, with the mantra ‘A bank for all of us’.

LBB> I really like the animation style of the film - where did the idea to make it 'look' like money come from? Was that something from Scholar or an idea you had beforehand?

Stefan> This was a lengthy process and we looked at so many options. We spent quite some time to really find something that served our key thought – bring money to life. Literally. Scholar inspired us and went further for us. And as genuine and intense as the work feels now, we found a way to make this really operational. We created a consistent look and are able to easily replicate it across channels for hundreds of outdoor and online assets.

LBB> There's a big outdoor element as well as the film - what can you tell us about that?

Stefan> A bank for all of us really has to go where all of us are. Bring this bank to every community, make it part of the local culture, be a mural next to your favourite coffee spot and first and foremost - be real and not just another digital banner that doesn’t last longer than a blink of the eye. We are now a visual part of our neighbourhoods.

LBB> And recently you launched an AR filter too - why was this a suitable extension of the initial launch campaign?

Kevin> Taking the message from the campaign and extending it to a digital touchpoint made it possible for everyone to experience Varo’s statement firsthand. The campaign provides such a strong image that we felt it was indispensable to create something with which people could play around and put their own face on a dollar bill. Not only did this enable us to take the campaign from print media to online but also put emphasis on the message ‘It’s your money’ and literally allowed people to claim their (uniquely created) money. The means of augmented reality allow for a playful interaction with the core message while at the same time creating an experiential touchpoint where the campaign could take off with its own digital direction. One that enables users on social media to share their own artwork created by the filter and thus supporting the message even stronger.

LBB> What kind of reaction have you seen to the campaign?

Stefan> Varo is a young brand and the campaign has only been in market for a few weeks, but it’s already getting recognised. We were ecstatic to win an industry award and client research shows some immediate results, plus the Varo customer base is growing fast. We also got so much support and feedback from the creative community, such as Glenn Cole, cofounder of 72andSunny.

And you might have heard that basketball legend Russell Westbrook has joined Varo as an investor to help spread the message.

LBB> What are the main aims of the campaign?

Stefan> We wanted to convey that Varo has the ability to disrupt and improve the traditional and outdated model of the financial community. Varo is the next generation of banking. We really want to create momentum, together with all those people who want to finally be in control of their hard-earned money. We are there for them and will not take it away from them by outrageous overdrafts or unnecessary fees. We want to make it easier and less daunting for them to handle their money. And of course we want to demonstrate how Varo wishes to grow with its customers.

LBB> What were the trickiest components and how did you overcome them?

Stefan> We are finally getting rid of systemic injustice in banking. If we can contribute to healthier and more happy communities that would be more than we could ask for. And timing was also crucial. We got to the stage of going live with the campaign in less than half a year, on multiple channels, with hundreds of assets that had to be produced in a timely and cost-efficient manner. Fortunately for us, we have the greatest client on earth to help us make this work. Varo still has the start-up mindset of a do-er despite the fact they are a fully recognised and chartered national bank now.

LBB> Any parting thoughts?

Stefan> This is a once in a lifetime opportunity. Serviceplan New York gets to help establish Varo as a unique disruptive innovator, challenging and changing the financial industry. This is as good as promoting the first smartphone or the first streaming platform. We get to make history with Varo.