Advertisers See Quarter Three as Recovery Turning Point

Wave three of The Coronavirus Effect on Advertising – a six-part, biweekly report from Advertiser Perceptions – shows that while the impact continues to intensify, advertisers expect Q3 to mark the turning point toward recovery in ad spending.

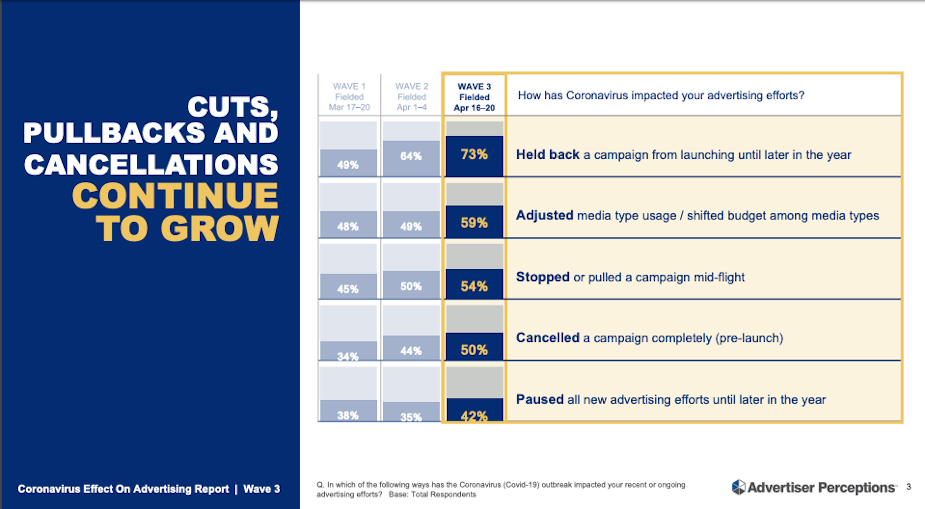

Cuts, pullbacks and cancellations continue to grow. In the past two weeks, 14% more advertisers have canceled a campaign pre-launch (total 50%), 17% more advertisers have held back a campaign launch (total 73%), and 20% more advertisers have paused all new advertising until later in the year (total 42%). Meanwhile, 17% more advertisers have previously unscheduled campaigns (total 28%), and 20% more advertisers have shifted their spending among media types (total 59%).

Q3 looks like the bottom. While 26% of advertisers expect to be spending more again by June 30th, 52% say they will resume or ramp up this summer – 18% in July, 15% in August, and 19% in September. Only 5% plan to wait until Q1 2021.

90 days is the new long term. Advertisers have cut their planning horizons in half, and are only committing to media less than three months out. Likewise, 75% of advertisers are giving media three months or less to present new options for commitments they have paused or shifted. Strategies for longer-term marketing, like back to school and holiday season, are still up in the air.

More advertisers eye economic factors. While the path of the virus and consumer behaviour still dominate decision-making, advertisers are factoring business realities into their recovery timelines more than they were two weeks ago. Fully 69% of advertisers now cite the economy as a factor in their calculations (up from 53%), and 43% say they will resume paused or canceled advertising after revenues have stabilised for one quarter (up from 27%).

Media have key opportunities in creative, context and performance. Roughly half of advertisers say they’re not sure how to communicate with consumers during the crisis. Their prime motivations for keeping or adding spending with media brands are contextual relevance and performance/advertising results. And 74% say contextual relevance is more important now than before the pandemic.

“Advertisers know they need more empathetic ads, but many aren’t sure about the message or lack creative,” said Justin Fromm, EVP/business intelligence at Advertiser Perceptions. “Media brands with deep audience intelligence can inform strategy and even produce creative tailored to their content.

“In the meantime, sellers need to key on contextual relevance and ad performance,” said Justin. “Pinpoint where a brand’s consumers are within the audiences for specific content, and show how ads perform for similar brands in consideration and action terms, most notably traffic and sales.”

Advertiser Perceptions surveyed 151 advertisers from April 16th-20th for Wave three of its Coronavirus report. Respondents were 36% marketer, 64% agency executives, all part of the company’s Ad Pros proprietary community.